Key results

- Sharper, accelerated insight enables agility

- Automated high-quality reporting enhances operational efficiency

- Enhanced data intelligence improves decision-making

- Faster implementation of requests optimizes business value

Data stack

Data ingestion: Fivetran

Data warehouse and lake: Snowflake

Data transformation: dbt

BI tool: ThoughtSpot

Use case: Self-serve analytics

Northmill Bank is a fintech company founded in 2006 by four Swedish entrepreneurs with a shared passion for technology, a conviction that modern banking is about people and a belief that the most effective – and fun – way of doing things is together.

Against a dynamic and shifting banking landscape shaped by new technologies, growing competition and increased customer demand for a tailored experience, Northmill positions itself between the digital and the personal – and has a firm customer-facing focus. It wants to improve its customers’ financial lives and make paying, saving and borrowing money hassle free.

Northmill has approximately 600,000 end users and around 160 full-time employees, the majority of whom are based in the company’s Stockholm HQ.

Northmill has been 100% cloud-based since 2015. In 2019, the company acquired its banking license, a huge milestone. In 2022, it added small business banking to its services, empowering over 2,000 entrepreneurs and merchants to tap into their potential.

Northmill is the highest rated bank in Sweden on Trustpilot with a score of 4.8/5. It wants to make that 5/5.

The challenge: ensuring reliability for business success

From its earliest days, Northmill understood that to be an organization with the ability to change and move fast, it would have to migrate to the cloud. As such, the bank was among one of the first in the Nordics to become 100% cloud-based.

Before it began using Fivetran for data ingestion, Northmill depended on a combination of different tools and approaches to gather the data it needed. It was far from an ideal setup; the tools – some developed in-house – were unreliable and the existing data warehouse platform did not perform sufficiently well, requiring considerable maintenance by various teams as there was no one centralized data analytics team to keep it up and running.

Often, data was late and incomplete, meaning business leads lacked crucial information when it was needed. Metrics were inaccurate, undermining decision-making. Data load job monitoring was poor or not available at all, and overall Northmill’s business was suffering.

The need for a reliable partner and solution that would provide stability and scalability was obvious. “We really wanted a partner that would grow with us and a product we could use in the long run,” says Zlatko Jankovic, Senior Data Engineer, Northmill, “without having to think about needing to switch to another solution any time soon.

“Fivetran is constantly evolving existing connectors and always developing and releasing new native connectors for different and various data sources. That was a big selling point for us.”

- Zlatko Jankovic, Senior Data Engineer, Northmill

The solution: achieving stability and scalability

When Northmill began its search around three years ago, Fivetran was already an established platform in the data ingestion tool world and one the bank found to be more than suitable; inexpensive, wholly reliable and with extensive coverage. “We didn’t even try to test other solutions,” says Jankovic. “We were out there looking, we found Fivetran at the top of every list and it was a no brainer for us; we went ahead and negotiated a new contract and literally started working with them within days of signing.”

Today Northmill has around 70 active connectors in its Fivetran accounts across several destinations that cover almost all its internal and external data sources. In addition, Jankovic and his team have developed a dozen AWS lambda functions which are used to support ingestion from external APIs. Though these sources aren’t currently supported by Fivetran, Northmill still uses Fivetran to orchestrate and schedule these data load jobs, making it a solid and reliable solution for the bank. “With this setup we’re getting all the benefits from standard Fivetran features,” explains Jankovic, “like different alerts in case of failures or incremental load support, historical resyncs and taking care of all the upserts or making data fresh and accurate.”

The option to develop a lambda function that connects to an API while still using Fivetran to sync responses, manage the connector and properly orchestrate was an appealing one for Northmill.

“We’re using that feature a lot,” explains Jankovic. “Sweden is a small market with lots of different startups developing different tools that aren’t widely popular globally. It’s hard sometimes to find support to ingest data from such tools, but with Fivetran solutions and being able to use cloud functions, it’s easy and performs well.”

The outcome: data democracy for enhanced decision-making

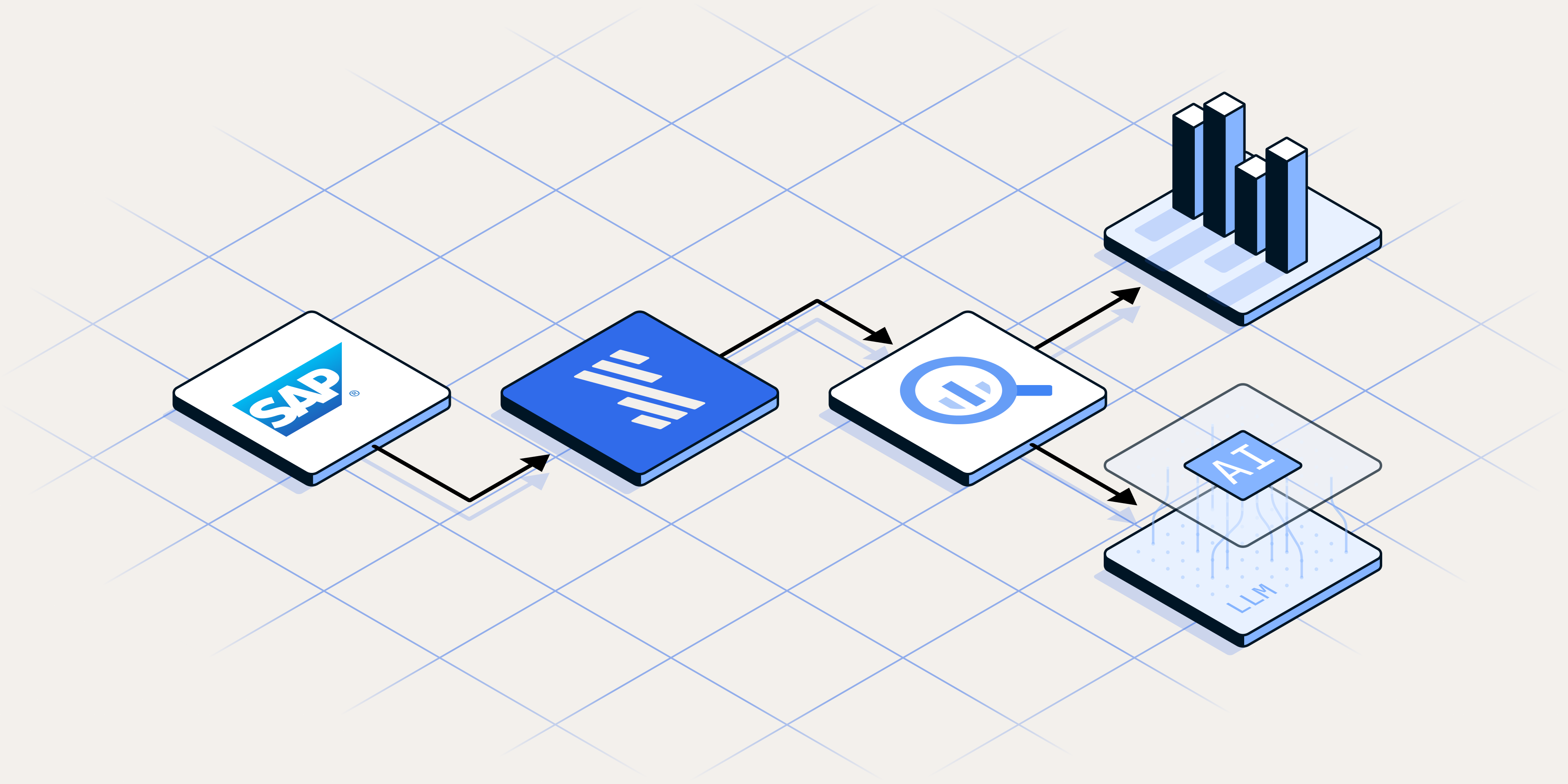

For Northmill, having the right information in the right form at the right time and place is crucial to business success. And having all the tools at its disposal working together in its ecosystem is what makes that possible. To be successful in its mission the bank relies entirely on timely and accurate data. Departments across the company are dependent on what Jankovic and his team offer as a product – data – and Fivetran has been key to that. “Fivetran is basically where everything starts,” explains Jankovic, “the reliability and completeness of data delivery, the ease and quickness to markets it provides, makes it very efficient and gives us more time to focus on delivering real business value in order to support the company and stay agile.”

Since Fivetran’s adoption, Jankovic has seen a rising trend in usage and trust in the data his analytics team provides. Whereas initially insights were mostly provided to credit departments, enabling them to make good credit decisions about products and customers, now the stakeholder pool has expanded. Not only is the team delivering to other departments in the company, it’s also introducing more and more people to working directly with the data. Explains Jankovic; “We really wanted to show everyone how important it is to be data-driven, to explore all that’s out there and what kind of offer we have – that’s crucial for our everyday activities.”

Now, every department and unit in the company relies on either dashboards in ThoughtSpot or queries data directly in Snowflake using the team’s data models. Data is becoming democratized, and the company is more and more data-driven. “We want data to be accessible to everyone,” says Jankovic, “we don’t want it to be perceived as a black box where people don’t know what’s in there – we want to give people the opportunity to use it and make business value out of it.”

Week-on-week the team sees requests to bring in more data as business units across Northmill realize how extracting data and building data models can lead to improved decision making. “That revelation, to know that everything is possible, has been a game changer for many business units,” says Jankovic.

Northmill has always had a firm customer focus and a belief that banking isn’t just about great products, it’s about relationships and trust. This Nordic bank is intent on creating the most intelligent and relevant banking experience possible and truly understanding how its customers’ financial lives can be improved. And to do that it needs to combine its data with the human touch between customers and employees.

Says Jankovic; “In this context I would say that Fivetran plays a really big role in enabling all of us to use our data in a way that our customers can get the most value.”

Download this IDC report to learn how Fivetran drives millions in financial impact and enables new business initiatives for enterprises.

%20(1).png)

.svg)

.svg)

.svg)