“We automate as much as possible. Fivetran and its whole ecosystem allows us to do so while complying with all governance, security and data protection requirements.” - Nicolas Kipp, Co-Founder and CRO at Banxware

Key results:

- Saved at least €140,000 per year, which is the equivalent of two full-time engineers by creating a flexible and scalable pipeline architecture with Fivetran and Snowflake

- Increased transparency and visibility into the data, leading to better decision-making and reduced risk

- Compliant with banking and security laws as well as the GDPR with Fivetran’s security capabilities

Data Stack:

- Pipeline: Fivetran

- Sources: Postgres, S3, DynamoDB, HubSpot

- Destination: Snowflake

- Transformations: dbt

- BI Tool: Tableau

- SI Partner: KEMB

German fintech startup Banxware is on a mission to modernize business finance. It enables digital platforms such as marketplaces, payments providers, POS providers and other aggregators to offer white label financial products, including loans to their merchants.

Some of its largest customers include Lieferando (Germany’s largest food delivery platform), everstox, PAYONE, ECOMMERCE ONE, TeleCash, Qonto, AGICAP, Fyrst, ALPHA POOL and Forto. The software easily integrates via an API, and the process for sellers is equally as fast and easy. They apply for a loan directly on the platform and define the terms. Within 15 minutes, the loan is approved, and the sellers receive their money. Banxware adheres to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulatory requirements for its clients.

As Banxware matured as a business, it needed to draw out meaningful and actionable insights, especially during COVID-19, to make more informed business decisions and better support its customers. However, it proved nearly impossible to find the right personnel to manually build and maintain data pipelines. After having evaluated several ELT tools, Banxware chose Fivetran for the following reasons:

- Built-in security, privacy and governance capabilities – which are absolutely critical in the finance market. This would ensure Banxware was also in compliance with the GDPR and other banking regulations.

- The ability to choose AWS hosting in the European Union for GDPR reasons

- The largest number of maintenance-free connectors (300+)

- Reliability offering 99.9 percent uptime

- Pipelines that automatically adapt to changes in source APIs and schemas

The implementation of Fivetran was completed within just a few days. Banxware also partnered with KEMB, a consultancy that specializes in business intelligence and digital transformation, and brought on dbt to modernize its data stack.

“It was great to have this ecosystem around Fivetran which is not only a cooperation of companies but a network of people, knowing each other and working together very closely. As well connected as these people are, we are able to connect our data easily.” - Nicolas Kipp, Co-Founder and CRO at Banxware

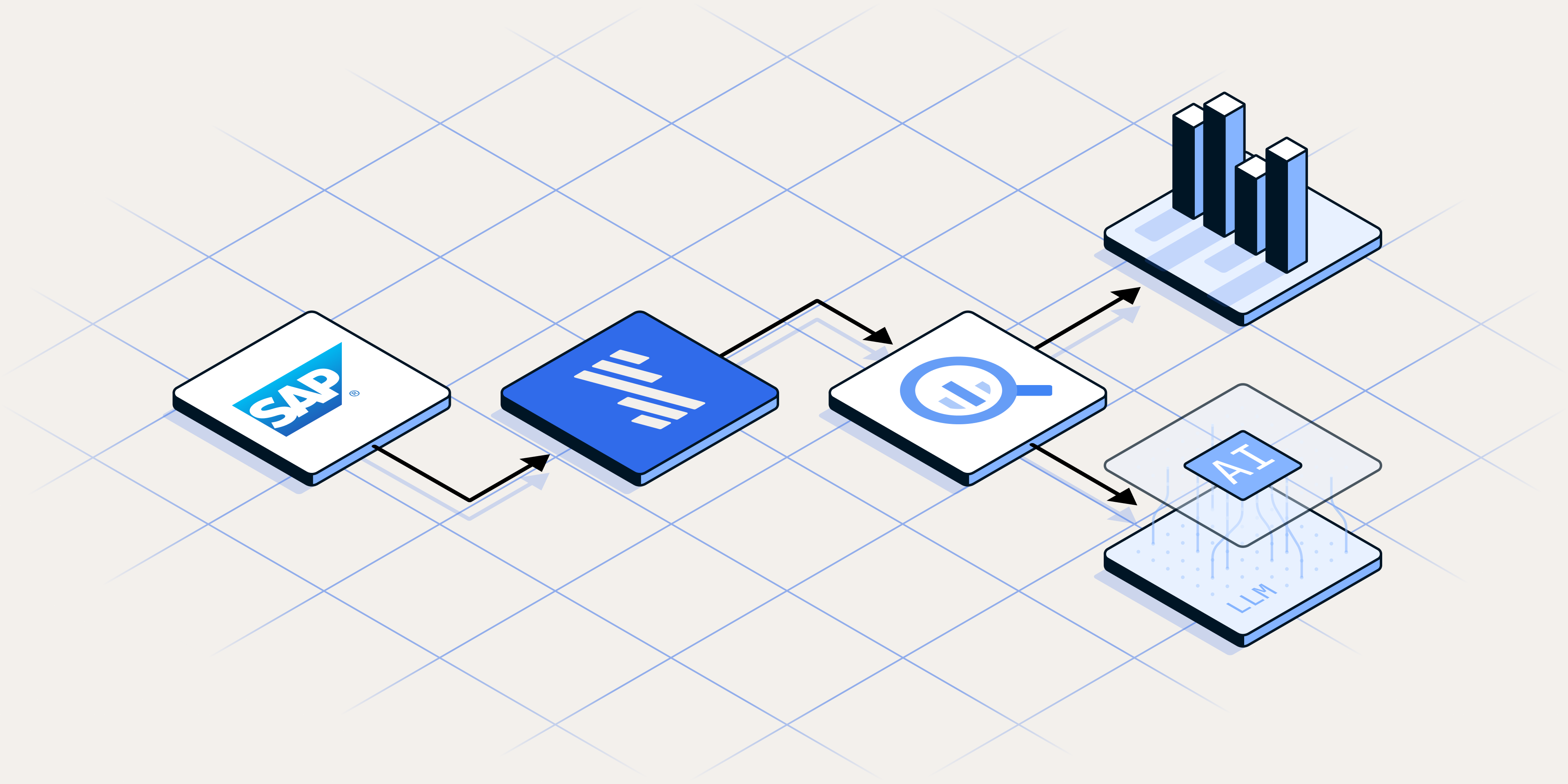

Today, Banxware uses Fivetran to ingest data from Postgres, S3, Dynamo and HubSpot into Snowflake to build Tableau dashboards and reports. The information provides valuable insights for its sales and customer support teams. These teams are able to better understand which sales channels to focus on, customer health and gain information about workloads. As a result, the company has greater transparency into every part of the business and all Banxware employees have access to the data they need to make better decisions on a day-to-day basis.

The team is now working to ingest data from Google Analytics to gain a more accurate view of its marketing funnel. Banxware will also create more dbt models for further insights. They use Fivetran Transformations for dbt Core to orchestrate custom database transformations which are synchronized with the ELS and Postgres connectors.

“Just a few years ago, companies had to build everything on their own and buy new hardware to scale their systems. Today, we are leveraging the modern data stack to automate our business intelligence and shape the setup with full flexibility based on our needs."

Download this IDC report to learn how Fivetran drives millions in financial impact and enables new business initiatives for enterprises.

%20(1).png)

.svg)

.svg)

.svg)